today’s dynamic and fast-evolving financial market, traders are constantly seeking strategies that offer consistency, risk control, and the potential to generate reliable profits. One such powerful approach is Options Selling, and with the emergence of advanced tools and techniques, it has now evolved into a more structured, data-driven practice—commonly referred to as Options Selling

This blog takes you through a step-by-step guide to understanding this upgraded strategy and how it can be used to scale your capital smartly and steadily.

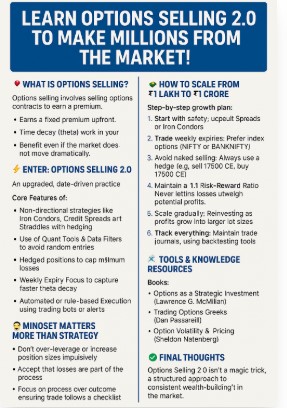

📌 What is Options Selling?

Options selling involves selling options contracts—either calls or puts—to earn a premium from the buyer. When executed strategically, the odds of profit can be significantly higher than buying options, particularly in a range-bound or sideways market.

Why is it powerful?

- You earn a fixed premium upfront.

- Time decay (theta) works in your favor.

- You can benefit even if the market does not move dramatically.

🔁 Enter: Options Selling

With the market becoming more competitive and algorithm-driven, traditional options selling techniques are no longer enough. This is where Options Selling steps in—a modern, systematic approach that uses technology, data analysis, and hedging strategies to reduce risk and enhance returns.

Core Features of Options Selling

- ✅ Non-directional strategies like Iron Condors, Credit Spreads, and Straddles with hedging.

- ✅ Use of Quant Tools and Data Filters to avoid random entries.

- ✅ Hedged Positions to cap maximum losses.

- ✅ Weekly Expiry Focus to capture faster theta decay.

- ✅ Automated or Rule-based Execution using trading bots or alerts.

This evolution makes the strategy more sustainable, scalable, and risk-managed—ideal for retail and full-time traders alike.

💸 How to Scale from ₹1 Lakh to ₹1 Crore

Growth in trading doesn’t come from luck—it comes from compounding and discipline. Here’s a simplified roadmap:

Step-by-Step Growth Plan:

- Start with Safety: Begin with capital protection using Credit Spreads or Iron Condors.

- Trade Weekly Expiries: Prefer index options (like NIFTY or BANKNIFTY) with high liquidity.

- Avoid Naked Selling: Always use a hedge—e.g., sell 17500 CE, buy 17600 CE.

- Maintain a 1:1 Risk-Reward Ratio: Never let losses outweigh potential profits.

- Scale Gradually: As profits grow, reinvest into larger lot sizes.

- Track Everything: Maintain trade journals, and use backtesting tools.

Even a consistent 2–3% monthly return can compound significantly over the years when losses are minimized.

🧠 Mindset Matters More Than Strategy

While strategies can be taught, discipline and mindset must be developed:

- Don’t over-leverage or increase position sizes impulsively.

- Accept that losses are part of the process.

- Focus on process over outcome—every trade should follow a checklist.

- Reflect on trades through journaling, screenshots, and analysis.

- Treat trading like a business, not a game.

🛠 Tools & Knowledge Resources

To succeed in Options Selling , traders should empower themselves with tools and resources:

📘 Books:

- Options as a Strategic Investment – Lawrence G. McMillan

- Trading Options Greeks – Dan Passarelli

- Option Volatility & Pricing – Sheldon Natenberg

📊 Tools:

- Option Chain Analysis tools

- Backtesting software (e.g., Opstra, StockMock)

- Journaling platforms (like Notion, Google Sheets)

- Algo execution platforms (for advanced users)

❗Common Mistakes to Avoid

Avoid these traps that often derail aspiring options sellers:

- ❌ Selling naked options without a stop-loss or hedge.

- ❌ Trading during high-volatility news events (like RBI or Fed meetings).

- ❌ Increasing position sizes after a win (greed-driven scaling).

- ❌ Blindly copying trades without understanding them.

- ❌ Ignoring capital preservation rules.

🔁 Recap: 10 Golden Rules for Options Selling

- Sell options only with a defined risk.

- Focus on high-probability range-bound trades.

- Avoid high IV trades unless volatility contraction is expected.

- Follow position sizing rules—risk only 1–2% per trade.

- Backtest and validate strategies.

- Never chase the market—wait for setups.

- Use hedging to control drawdowns.

- Stay away from low liquidity stocks/options.

- Maintain a trading journal.

- Let compounding do the magic over time.

✅ Final Thoughts

Options Selling isn’t a magic trick—it’s a structured approach to consistent wealth-building in the market. With the right mindset, tools, and discipline, this strategy can generate monthly income and long-term growth, while keeping risk under control.

Whether you’re just starting with ₹1 lakh or looking to scale to ₹1 crore, the key lies in consistency, risk management, and systematic execution.

📢 Disclaimer

Investments in the securities market are subject to market risks. The strategies discussed above are for educational purposes only and do not constitute financial advice. Please consult a registered financial advisor before making any investment decisions. Past performance does not guarantee future results. Options trading involves substantial risk and is not suitable for every investor.