Why Most Traders Struggle with Reversals

Reversal trades can be tricky. Many traders lose money trying to predict market turns, especially in volatile instruments like Bank Nifty. But what if you could spot reliable patterns and turn reversals into consistent profit opportunities?

That’s exactly what I set out to explore—and what I found could be a game-changer for option sellers.

The Setup: Bearish Reversals + Options Selling

The strategy focuses on spotting a Bearish Engulfing Pattern, selling call options on confirmation, and riding the move down. Here’s how it works:

🔍 Step 1: Identify a Bearish Engulfing Pattern

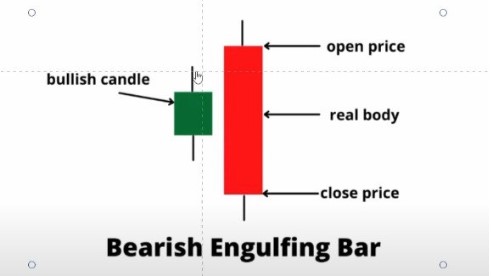

A bearish engulfing pattern happens when:

- A large red candle fully engulfs the previous small green candle.

- The red candle opens higher than the green candle’s high and closes below its low.

This pattern indicates strong selling pressure and hints at a potential reversal.

Who Can Use This Strategy?

This setup is ideal for:

- Traders looking to profit from falling markets

- Option sellers, particularly those who prefer call selling

- Traders using intraday or overnight strategies

- How to Execute the Trade

- Here’s a step-by-step breakdown:

- Spot a bearish engulfing pattern on the daily chart.

- Sell call options—either naked or hedged—towards the close of that day.

- Hold overnight, anticipating a gap-down opening.

- Book profits at market open the next day.

- 📌 Tip: Avoid getting greedy—exit early. A morning reversal can wipe out overnight gains.

Real Examples in Action

📅 April 18 – Bank Nifty

- Bank Nifty was range-bound.

- A clear bearish engulfing pattern formed.

- Call options were sold at the close.

- The next day: a 400-point gap-down. ✅ Strategy success!

What If the Market Rises the Next Day?

Even after a gap-down, intraday bounces can surprise traders.

On the 15-minute chart, if the market starts making higher highs, it’s time to:

➡️ Shift strategy

➡️ Sell puts below the day’s low to benefit from intraday strength.

Risk Management Matters

Trading reversals without protection is risky. Here’s how to safeguard your capital:

- Hedge trades if unsure.

- Use a stop loss at 2x the premium sold. (E.g., sold at ₹50, stop loss at ₹100)

- Follow your rules. No emotional trades.

Smart Backtesting for Smart Markets

Backtesting is important—but not endlessly. Focus on:

- Recent 6–12 months of data.

- Adaptability to current market structures.

- Avoiding outdated patterns that no longer work.

💡 Pro Tip: Look for strong Marubozu red candles in bearish engulfing setups. Ignore setups with weak or wick-heavy candles.

Conclusion: Simplicity Wins

This Bank Nifty reversal strategy, built around bearish engulfing patterns and option selling, is simple, practical, and profitable—if executed with discipline. As market conditions evolve, so should our strategies. Stay observant, test frequently, and manage risk like a pro.

Want more setups like this? Keep learning, stay nimble, and trade safe!

📢 Disclaimer:

The information provided in this blog is for educational and informational purposes only. It is not intended as investment advice, financial advice, trading advice, or any other form of recommendation.

Trading and investing in financial markets, including derivatives like options, involves substantial risk. The strategy discussed—based on technical patterns like the bearish engulfing—may not be suitable for all traders and could result in significant financial losses.

Past performance is not indicative of future results. Market conditions change and no trading strategy guarantees success. Please conduct your own research, use proper risk management, and consult with a certified financial advisor before making any investment decisions.

The author is not responsible for any financial loss or gain that may arise from using the content in this blog.